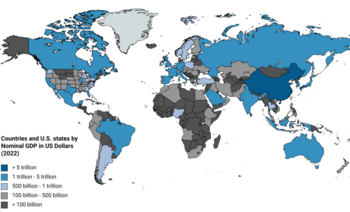

As of 2007, the gross state product (GSP) is about $1.812 trillion, the largest in the United States. California is responsible for 13 percent of the United States gross domestic product (GDP). As of 2006, California's GDP is larger than all but eight countries in the world (all but eleven countries by Purchasing Power Parity).

In terms of jobs, the five largest sectors in California are trade, transportation, and utilities; government; professional and business services; education and health services; and leisure and hospitality. In terms of output, the five largest sectors are financial services, followed by trade, transportation, and utilities; education and health services; government; and manufacturing.

California currently has the 5th highest unemployment rate in the nation at 12.5% as of January 2010 and had continued to rise, up significantly from 5.9% in 2007.

California's economy is very dependent on trade and international related commerce accounts for approximately one-quarter of the state’s economy. In 2008, California exported $144 billion worth of goods, up from $134 billion in 2007 and $127 billion in 2006. Computers and electronic products are California's top export, accounting for 42 percent of all the state's exports in 2008.

Agriculture is an important sector in California's economy. Farming-related sales more than quadrupled over the past three decades, from $7.3 billion in 1974 to nearly $31 billion in 2004. This increase has occurred despite a 15 percent decline in acreage devoted to farming during the period, and water supply suffering from chronic instability. Factors contributing to the growth in sales-per-acre include more intensive use of active farmlands and technological improvements in crop production. In 2008, California's 81,500 farms and ranches generated $36.2 billion products revenue.

Per capita GDP in 2007 was $38,956, ranking eleventh in the nation. Per capita income varies widely by geographic region and profession. The Central Valley is the most impoverished, with migrant farm workers making less than minimum wage. Recently, the San Joaquin Valley was characterized as one of the most economically depressed regions in the U.S., on par with the region of Appalachia. Many coastal cities include some of the wealthiest per-capita areas in the U.S. The high-technology sectors in Northern California, specifically Silicon Valley, in Santa Clara and San Mateo counties, have emerged from the economic downturn caused by the dot-com bust.

In 2010, there were more than 663,000 millionaires in the state, more than any other state in the nation.

State finances

California levies a 9.3 percent maximum variable rate income tax, with six tax brackets, collecting about $40 billion per year (representing approximately 51% of General Fund revenue and 40% of tax revenue overall in FY2007). California has a state sales tax of 8.25%, which can total up to 10.75% with local sales tax included. All real property is taxable annually, the tax based on the property's fair market value at the time of purchase or completion of new construction. Property tax increases are capped at 2% per year.

However, California is facing a $26.3 billion budget deficit for the 2009–2010 budget year. While the legislative bodies appeared to address the problem in 2008 with the three-month delayed passage of a budget they in fact only postponed the deficit to 2009 and due to the late 2008 decline in the economy and the credit crisis the problem became urgent in November 2008.

One potential problem is that a substantial portion of the state's income comes from income taxes on a small proportion of wealthy citizens. For example, it is estimated that in 2004 the richest 3% of state taxpayers (those with tax returns showing over 200K USD yearly income) paid approximately 60% of state income taxes. The taxable income of this population is highly dependent upon capital gains, which has been severely impacted by the stock market declines of this period. The governor has proposed a combination of extensive program cuts and tax increases to address this problem, but owing to longstanding problems in the legislature these proposals are likely to be difficult to pass as legislation.

State spending increased from $56 billion in 1998 to $131 billion in 2008, and the state was facing a budget deficit of $40 billion in 2008. California is facing another budget gap for 2010,with $72 billion in debt.

In 2009 the California economic crisis became severe as the state faced insolvency. In June 2009 Gov. Arnold Schwarzenegger said "Our wallet is empty, our bank is closed and our credit is dried up." He called for massive budget cuts of $24 billion, about 1⁄4 of the state's budget.

No comments:

Post a Comment